Delta Air Lines is an airline that generates a lot of loyalty. For those who live in major hub cities such as Atlanta, Minneapolis, Detroit and Salt Lake City, Delta Air Lines can be your key to flying nonstop to most U.S. cities and many overseas destinations. Delta attracts many travelers to other cities because of its reputation for customer service and operational reliability, as well as the many perks offered by its Medallion program.

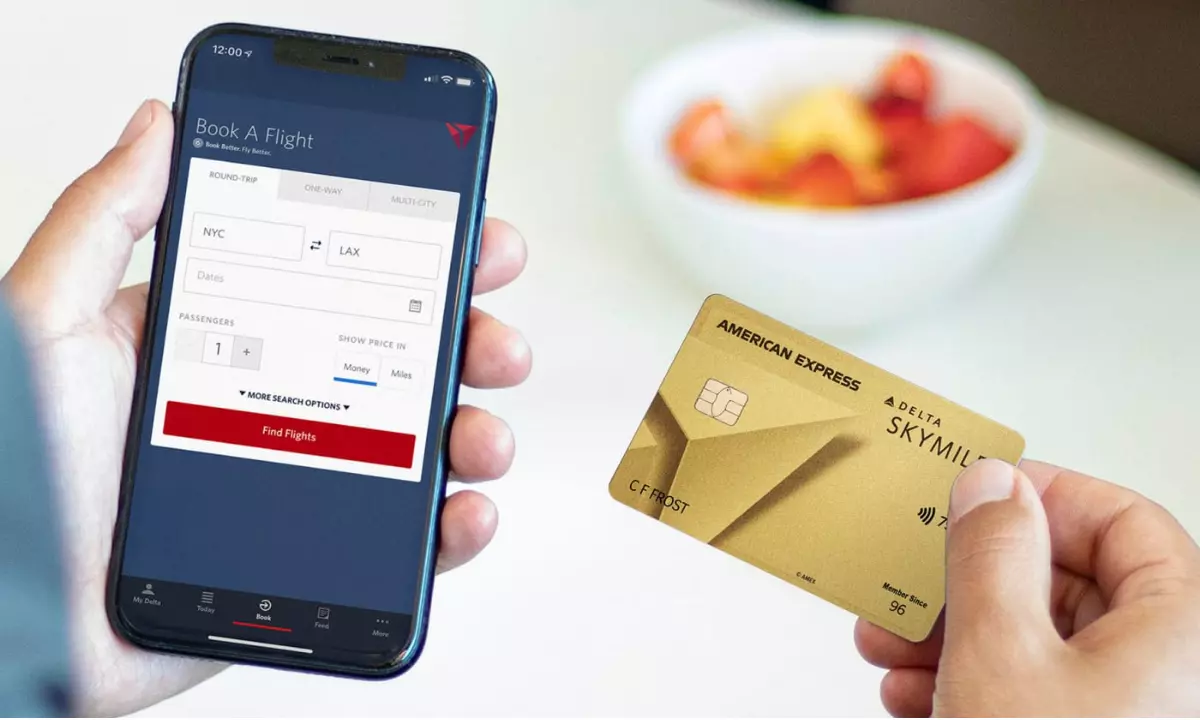

I live in Atlanta and travel a lot for work, and I’m a big fan of the airline and its Delta SkyMiles® Gold American Express Card. The card still offers great welcome bonuses, double miles spent every day, and great perks on Delta Air Lines. Here are five reasons to love SkyMiles Gold.

1. No annual fee for the first year

This current offer on this co-branded Delta credit card includes a $0 annual introductory fee for the first year. After your first year of membership, the annual fee is $99. After using the card for a year, see if it’s worth it.

This card also gives you $100 in Delta flight points: After you spend $10,000 on purchases made with your card in a calendar year, you’ll earn points that you can use toward future travel. As long as you pay an average of $834 per month, you’ll get credit over and above paying the annual fee.

2. Satisfactory welcome bonus

When you open an account with the American Express Delta SkyMiles Gold Card, you can earn 40,000 SkyMiles by spending just $1,000 within three months of account opening. Although Delta Air Lines no longer publishes SkyMiles award schedules, the bonus is worth at least $400 in award travel, and often more. Additionally, new cardholders can receive up to $50 back on their bill for eligible purchases at U.S. restaurants within the first three months.

With Delta’s SkyMiles frequent flyer program, the number of miles required for an award is usually very close to the dollar price of the award. So you know you usually get about a cent per mile, maybe more. Many other programs will sometimes give you great value for money, but you’ll also often find bad value. Fans of Delta’s SkyMiles program love its consistency.

3. Earn bonus miles outside of Delta purchases

I’m always frustrated that most airline credit cards only offer one mile per dollar spent on anything other than airline purchases. But with Delta SkyMiles Gold, you’ll earn Double Miles on restaurant meals, including takeout and delivery in the U.S. Earn Double Miles on U.S. supermarket purchases. So when you dine, you get double miles. Of course, earn Double Miles on all Delta purchases, including airfare, fees, and any other purchases made directly through the airline.

4. Enjoy multiple Delta benefits

Where Delta SkyMiles Gold really shines is in its many valuable benefits while flying. Like many airline credit cards, you get one piece of checked luggage for free. But with SkyMiles Gold, this benefit can be extended to up to 8 other passengers who book with you. On a few occasions, I’ve used this perk to save hundreds of dollars on family ski vacations and other long trips where I have to check a lot of luggage.

After boarding, you also have priority boarding in Main Cabin 1. This means you’ll board before most other passengers and can store your carry-on luggage in the overhead bin next to your seat. If you board later, you run the risk of being forced to check in your luggage if the aircraft doesn’t have enough storage space.

SkyMiles Gold members can also take advantage of Delta’s Pay with Miles program to reduce the cost of purchasing tickets on Delta.com. While you only get one penny worth of every mile you redeem, these tickets still earn you redeemable miles and elite status points—just like tickets purchased with cash. It would make the most sense if my goal was to get elite status and I could find discounted tickets.

Finally, this card gives you a 20% discount on in-flight purchases. This always takes the hassle out of paying for things like meals, drinks, and audio headphones.

5. Numerous advantages for American Express cardholders

If you haven’t heard, many credit card issuers have eliminated some of their long-standing and most valuable cardholder benefits. Thankfully, American Express holds its own and still offers plenty of travel insurance and shopping protection benefits.

When you travel, you can get rental car loss and damage insurance that Citi, Discover and other cards no longer offer. I especially like using the American Express Premium Car Rental Protection option, which costs $19.95 or $24.95 per rental instead of per day. This is a great option for long-term rentals and where you’re particularly concerned about damage.

For purchases, this card offers a Purchase Protection Plan, which pays up to $1,000 per activity and up to $50,000 per calendar year. Receive this benefit if your qualifying purchase is stolen or damaged within 90 days of purchase. Claiming nearly $50,000 in damages in a year must be out of luck, but I did use the benefit to recover hundreds of dollars worth of personal purchases in accidental losses.

But in addition to the 90-day purchase protection, you can also get an additional year of extended warranty coverage for eligible items with a five-year warranty or less. This allows you to deny expensive add-on warranties sold by retailers.

Resultado final

There are dozens of airline credit cards on the market today, but the Delta SkyMiles Gold Card stands out. The annual fee is $99, which equates to a $0 introductory fee for the first year, and I found them in the Goldilocks zone between the free Delta SkyMiles® Blue American Express Card and the $250 Delta SkyMiles® Platinum American Express Card— — Not to mention the $550 Delta SkyMiles® Reserve American Express Card.

With a decent welcome bonus for new cardholders, double miles on multiple purchases, and many valuable perks, Delta SkyMiles Gold certainly earns a place in your heart as well.

Aprende más:

-

-

-

-

Revisión de la tarjeta Delta Skymiles® Reserve American Express - Ver más.

-

-

Recompensas de la tarjeta Discover it® Rewards vea cómo funciona