It’s no secret that the cost of higher education is at an all-time high. However, prospective students can do a lot to offset the high cost of college. To go to college for free, you can apply for scholarships, work for your school, find tuition-free courses, and more.

How much does college cost?

Tuition fees have increased over the past 10 years. The average 2011-12 tuition and fees at public four-year colleges and universities was $9,890 (in 2021 dollars), according to College Board data. In 2021-22, the figure is $10,740. For private four-year colleges, the gap is even wider; from 2011-12 to 2021-22, average tuition and fees increased from $33,320 to $38,070.

The cost of college depends a lot on the school you want to attend. Here’s how the College Board breaks down average costs for the 2021-22 academic year:

| Expenses | Average cost |

| Public university tuition | $10,740 for in-state students; $27,560 for out-of-state students |

| Private university tuition | $38,070 |

| Room and board | $11,950 for public universities; $13,620 for private universities |

| Books and supplies | $1,240 |

| Transportation | $1,230 for public universities; $1,060 for private universities |

| Personal expenses | $2,170 for public universities; $1,810 for private universities |

How to get into college for free?

It’s important to explore all the ways you can avoid spending a lot of money (if at all) on college. Here are the best strategies.

1. Apply for grants and scholarships

There are thousands of programs, agencies, companies, and organizations that give away money for free. Scholarships are usually need-based, while scholarships are based on academic, artistic or athletic merit.

You can apply for federal and school-level grants and scholarships by completing the FAFSA. Check with your school counselor or college financial aid office if you qualify for funding from a local program or a specific agency.

The Scholarship Search Engine is an easy way to find scholarships outside of college courses. You can customize your search based on a variety of factors, including:

- Ethnicity.

- Race.

- Gender.

- Potential major.

- Financial need.

- Military affiliation.

- Physical disabilities.

- Religion.

The sooner you start your search, the more free money you can get. Many grants and scholarships are awarded on a first-come, first-served basis. So the sooner you apply, the more money you make.

2. Serve your country

The U.S. Coast Guard, Air Force, Military (West Point), Merchant Marine, and Naval Academy offer free college opportunities to students serving after college. Scholarships are also available through the local Reserve Officer Training Corps (ROTC) program.

Offered at more than 1,700 colleges and universities in the United States, the ROTC program provides participants with a paid college education and a guaranteed post-college career in exchange for a commitment to serving in the military upon graduation.

AmeriCorps is another national service organization that offers educational awards in exchange for community work. Award amounts for the AmeriCorps program vary, but individuals cannot receive “more than the combined value of two full-time National Service training awards.” The Comprehensive Education Award is the highest value of a Pell Grant that year. Members also receive a living allowance while participating in the program.

If you served on or after September 11, 2001, you may also be eligible for the Post-9/11 GI Bill, which helps pay for state tuition and fees and provides subsidies for living expenses, books, and supplies. Those eligible for the program’s greatest benefit will bear the full cost of public state tuition and fees for 36 months. Private and foreign schools have funding restrictions.

3. Choose a school that can pay you

Some schools will pay you to focus your studies on a single subject of their choice. Schools such as Webb College and the Curtis Institute of Music offer a selection of academic programs and pay tuition per student.

However, it is important to consider your decision before taking this course. You don’t want to bother taking free college courses just to graduate and find out that you are no longer interested in the subject.

4. Forgo your expenses

Some students may receive free passes based on academic performance or other factors.

“Tuition waivers are available for (current and former) military students and talented students,” said Manuel Fabriquer, founder of College Planning ABC, a financial aid and admissions consulting firm based in San Jose, Calif. Say. “Even well-income families can have tuition waived if [students] have the correct test scores.”

5. Find Tuition-Free Online Degree Programs

Community colleges aren’t the only schools offering tuition-free programs. Some employers offer free college courses to their employees. For example, Starbucks has partnered with Arizona State University (ASU) to offer employees combined tuition for online courses and degrees.

The Curtis Institute of Music in Philadelphia and Berea College in Kentucky are two schools that offer tuition-free online programs. You can Google for more online tuition-free degrees that may be especially suitable for students who want to continue living at home.

6. Choose an in-demand career

Another great way to study for free at university is to find a high-demand field of study. If you want to lower your college costs, please consider this before enrolling.

Maths, science, nursing, teaching and social work are all subjects the university can support through scholarships. There are other opportunities through organizations such as Teach for America and the Nurse Corps Loan Repayment Program, where you can receive a TEACH scholarship of up to $4,000 per year in exchange for your commitment to teach in a low-income school or educational service for the first eight years after graduation for four .

7. Go to vocational school

Work colleges are another way to get a free or heavily discounted college education. These schools are typically four-year liberal arts institutions that provide educational opportunities and valuable work experience.

Please note that all students are required to participate in full work study services during all four years of enrolment. In other words, all resident students have jobs. These jobs are usually located on campus, but off-campus jobs are also possible. Specific course details vary by college.

All participating universities are approved and supervised by the U.S. Department of Education and must meet certain federal standards.

8. Work for the school

Many schools offer free or discounted tuition to school employees and staff. Additionally, if a student’s parents work for the university, the student may be eligible for a full or partial exemption. Since there are no minimum standards, conditions vary by institution, but many full-time employees qualify for tuition-free courses. Prospective students can learn about their school’s policies by calling the admissions office.

9. Community Colleges for Free Degree Programs

Many community colleges now offer free degree programs; Tennessee, Oregon, California, New York, and Washington are examples of states that have introduced free community college versions.

In many states, you must graduate from a state high school and be enrolled full-time to qualify for a free degree program. You may also have to commit to staying in the state for several years after graduation. Although tuition is free, you may still have to pay for textbooks, materials and room and board.

10. Make your employer cover the cost

There are many companies that offer tuition reimbursement, including Chegg, Google, and Hulu. Ask your employer if they are willing to pay back all or part of your tuition. Tuition fees of up to $5,250 per year are tax-deductible for both employees and employers.

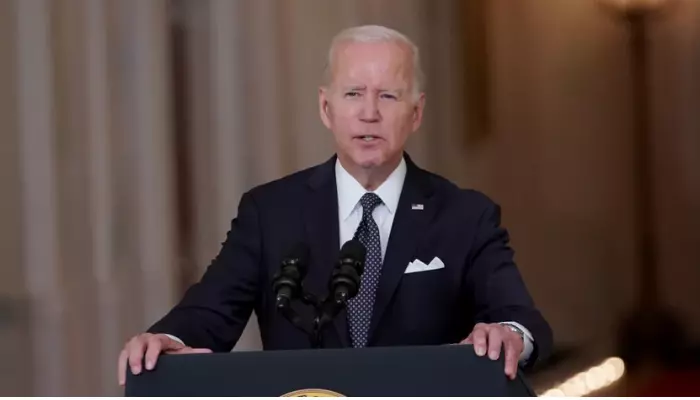

Will President Biden make college free?

During the campaign, President Biden said saving all Americans from community college tuition was a priority. Unfortunately, the president was forced to remove the proposal from his spending bill, citing some opposition from moderate Democratic senators.

It’s unclear what the path to tuition-free community colleges will be — especially if Republicans retake one or both houses of Congress by mid-2022.

What if I apply for student loans?

If you’ve done everything you can to get free college and still need to pay some of your costs, student loans can help bridge the financial gap.

Whether it’s federal student loans or private student loans, you should only borrow what you need. Every dollar you borrow is a dollar you must pay back with interest. The more you borrow now, the more you end up paying back when you leave school. While Biden suggested on his campaign that he would be willing to forgive $10,000 of student loan debt per borrower, there is no official plan — so you should plan to pay off the full balance.

Federal student loans are available if you complete the FAFSA. These include flexible repayment terms such as income-based repayment plans, waiver options, and longer deferral and forbearance periods. If you’re still struggling to pay for college and have exhausted your federal loan limit, you may need a private student loan, which may have higher interest rates and less borrower protection. In this case, it’s important to research some lenders before applying for student loans to keep costs as low as possible.

Resultado final

While a free college education is possible, it requires a lot of time, energy, and dedication. Start your search early and apply for as many scholarships, grants, and other programs as possible. Casting a wide net gives you the best chance of getting into college for free. If you haven’t filled the void, applying for student loans can help you do the rest.

Aprende más:

-

-

-

-

Revisión de la tarjeta Delta Skymiles® Reserve American Express - Ver más.

-

-

Recompensas de la tarjeta Discover it® Rewards vea cómo funciona