Prezydent Joe Biden może nie podjąć decyzji o umorzeniu pożyczek studenckich przed lipcem lub sierpniem.

Oto, co musisz wiedzieć i co to oznacza dla Twoich kredytów studenckich.

Pożyczki studenckie

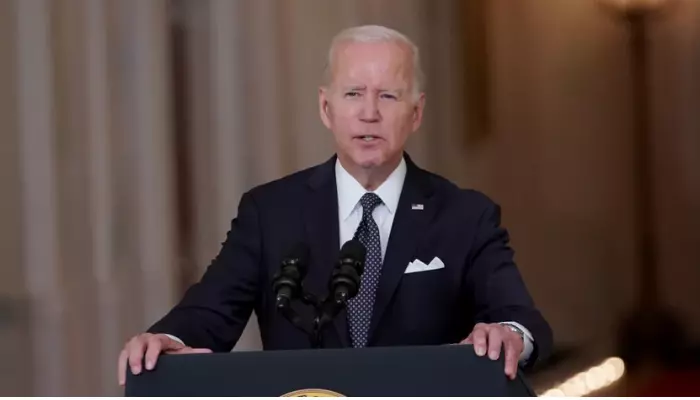

Biden może ogłosić decyzję o całkowitym umorzeniu długów studentom dopiero pod koniec lata, co będzie frustrującym ciosem dla milionów kredytobiorców. Według „Wall Street Journal”, powołującego się na urzędników administracji Bidena, prezydent „będzie nadal rozważał polityczne i ekonomiczne konsekwencje decyzji o anulowaniu pożyczek studenckich”. Pod koniec kwietnia prezydent zapowiedział, że ogłosi decyzję w ciągu kilku tygodni. Jednak sześć tygodni później Biden nie ogłosił, czy wprowadzi kompleksowy podatek od kredytów studenckich.

Dlaczego umorzenie pożyczek studenckich zostało opóźnione

Umorzenie pożyczek studenckich może zostać opóźnione z kilku powodów. Biden na przykład może wciąż rozważać polityczne za i przeciw tej ważnej decyzji politycznej. Biały Dom zaprzeczył doniesieniom o decyzji Bidena o umorzeniu długu studenckiego w wysokości $10 000. Zwolennicy szerokiego umorzenia kredytów studenckich, tacy jak senator Elizabeth Warren (DMA), twierdzą, że głębokie umorzenie kredytów studenckich pobudzi gospodarkę i pomoże kredytobiorcom zaoszczędzić dodatkowe pieniądze na zawarcie związku małżeńskiego, założenie rodziny, zakup domu i przygotowanie się do oszczędzania na emeryturę. Przeciwnicy, tacy jak senator Tom Cotton (R-AR), twierdzą, że szerokie umorzenie kredytów studenckich to ogromny transfer bogactwa, który uderzy w tych, którzy nie chodzili do college'u lub nie mają kredytów studenckich. Od momentu objęcia urzędu Biden utracił 14 miliardów TP25 miliardów dolarów z tytułu kredytów studenckich. Zajmuje się umorzeniem kredytów studenckich dla określonych grup studentów. Chociaż Biden mógłby kontynuować ukierunkowane łagodzenie warunków kredytów studenckich, pytanie brzmi, czy zgodziłby się na kompleksowe umorzenie kredytów studenckich większości lub wszystkim z 45 milionów kredytobiorców.

Biden może rozważyć umorzenie pożyczki studenckiej w wysokości $50 000

Biden ostatecznie wykluczył umorzenie pożyczki studenckiej w wysokości $50 000. Popiera umorzenie pożyczek studenckich w wysokości $10 000, ale nigdy nie popiera większej kwoty, za którą opowiadają się Warren i lider większości w Senacie Chuck Schumer (demokrata z Nowego Jorku). Jednak ponowna mobilizacja ze strony głównych grup obywatelskich i społecznych może przekonać Bidena do poparcia umorzenia kredytów studenckich w kwocie $50 000. Dlaczego Biden miałby poprzeć szersze umorzenie kredytów studenckich? Podstawowym powodem umorzenia pożyczki studenckiej w wysokości $50 000 jest chęć zmniejszenia nierówności i umożliwienia 36 milionom kredytobiorców umorzenia całego federalnego zadłużenia z tytułu pożyczek studenckich. Jednak najbardziej prawdopodobnym scenariuszem umorzenia pożyczki studenckiej jest anulowanie pożyczki studenckiej na kwotę $10 000, przy limicie dochodów wynoszącym co najmniej $125 000.

Biden może również brać pod uwagę implikacje polityczne

Oprócz oceny wpływu polityki i wielkości potencjalnego umorzenia pożyczek studenckich, Biden musi również rozważyć wpływ polityki. Wybory uzupełniające odbędą się 8 listopada, a Demokraci prawdopodobnie stracą swoje miejsca w Kongresie. Może to doprowadzić do zwycięstwa Republikanów w co najmniej jednej Izbie Kongresu, co doprowadzi do podziału rządu i utrudni realizację prezydenckich planów legislacyjnych. Postępowi członkowie Kongresu uważają, że kompleksowe ustawodawstwo dotyczące pożyczek studenckich będzie miało kluczowe znaczenie dla skłonienia Demokratów do głosowania w listopadzie. Sądzą, że wyborcy zagłosują albo nie na kandydata Partii Republikańskiej, jeśli pożyczki studenckie nie zostaną anulowane. Kontrargumentem jest to, że jeśli Biden wprowadzi ogromny podatek od kredytów studenckich, może to zniechęcić niezależnych i umiarkowanych wyborców. Demokraci potrzebują obu okręgów, aby utrzymać władzę w Kongresie.

Pożyczki studenckie: kolejne kroki

Jeśli Biden opóźni ogłoszenie o umorzeniu pożyczek studenckich do lipca lub sierpnia, będzie to bliżej końca tymczasowego umorzenia pożyczek studenckich, tj. 31 sierpnia 2022 r. Może to mieć poważne konsekwencje dla pożyczkobiorców pożyczek studenckich, którzy czekają na informację, czy otrzymali przynajmniej część swoich pożyczek, które zostaną anulowane. Spłata pożyczek studenckich rozpocznie się 1 września 2022 r., więc to najwyższy czas, aby się przygotować. Niezależnie od decyzji prezydenta, powinieneś mieć gotowy plan spłaty pożyczek studenckich. Oto sprytne sposoby oszczędzania pieniędzy:

- Refinansowanie kredytu studenckiego (niskie oprocentowanie + niska rata)

- Dochód zależny od spłaty (niższe koszty)

- Umorzenie pożyczek studenckich (federalne pożyczki studenckie).

Ucz się więcej: