While not as common as it once was, checks are still widely used, even in today’s digital world. Paper checks are an effective and inexpensive transfer tool, but you probably don’t write checks every day (or you never have before).

Writing checks is easy, and this tutorial will show you how. Go through each step individually, or just use the example above as a model for the reviews you need to write. You can perform these steps in any order as long as the finished product does not lack any critical information. In this example, you’re moving from top to bottom, which should help you not skip any steps.

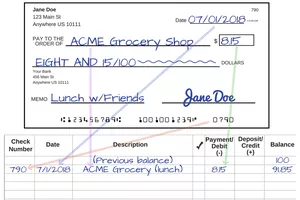

1 Example

Here’s an overview of the perfect check.

Here’s an overview of the perfect check.

1ª Current date: written in the upper right corner. In most cases, today’s date is used, which helps you and the recipient maintain accurate records. You can also date the check, but it doesn’t always work the way you want.

2ª Beneficiary: In the “Pay on behalf” line, enter the name of the person or organization you want to pay. You may have to ask, “Who do I need to bill?” if you’re not sure what to write, as this information needs to be accurate.

3ª Amount in digital form: Write your payment amount in the small box on the right. Start writing as far to the left as possible. If your payment is $8.15, the “8” should be just to the left of the dollar box to prevent fraud. See an example of how to enter an amount.

4ª Write the amount in words: Write the amount in words to avoid fraud and confusion. This is the official amount you pay. If this amount is different from the number you entered in the previous step, the amount you put in text is legally the amount on your check. Only use uppercase letters as these are harder to change.

5ª Signature: Clearly sign the line on the lower right corner of the check. Use the same name and signature as your bank. This step is essential – checks that are not signed are invalid.

6ª Memo Line (or “Offer”): You can add a note if you wish. This step is optional and does not affect how the bank processes your check. Comment lines are a great place to remind yourself why you wrote the check. It could also be where you write the information that the recipient will use to process your payment (or find your account if something is misplaced). For example, if you’re paying the IRS, you can put your Social Security number on this line, or use an account number to pay for utility bills.

After writing the check, record the payment. Whether you use an electronic register or a paper register, the check register is the perfect place to do this. Recording payments prevents you from spending money twice – the money will continue to show in your account until the check is deposited or cashed, which can take a while. It’s best to jot down the payment when you’re clear-headed.

Before you write a check, make sure it’s really what you need to do. Writing checks is cumbersome and not the fastest way to send money. You may have other options that can make your life easier and help you save money. For example, you can:

-

Pay bills online and even instruct your bank to automatically send checks every month. You don’t have to write a check, pay postage, or mail a check

-

Get a debit card and use it to spend. You pay from the same account, but you pay electronically. You don’t have to use up any checks (you have to reorder them), and you have an electronic record of the transaction with the payee name, payment date and amount.

-

Set up automatic payments for recurring payments like utilities and insurance. This payment method is usually free and makes your life easier. Just make sure you always have enough cash in your account to pay your bills.

No matter how you pay, make sure you always have enough funds in your checking account. If you don’t, your payments could “bounce” and cause problems, including high fees and potential legal issues.

2 Record payments in your check register

-

Track your spending so you don’t bounce tickets.

-

Know where your money goes. Your bank statement should only show the check number and amount – no indication of who you wrote the check to.

-

Detect fraud and identity theft in your checking account.

When you received your checkbook, you should have already received your checkbook. If you don’t have one, you can easily create one yourself using paper or spreadsheets.

Copy all important information from the check:

-

Cheque number

-

The date you wrote the check

-

A description of the transaction or to whom you wrote the check

-

How much is the payment.

If you need more details on where to find this information, see the chart showing the different parts of a check.

You can use your cash register to balance your checking account. This is the practice of double-checking every transaction in your bank account to make sure you and the bank are on the same page. You’ll know if there are any errors in your account, and if someone hasn’t deposited the check you wrote (making you think you have more money to spend).

Your check register also provides an instant view of how much money you have on hand. Once you’ve written a check, you should assume the money is gone — in some cases, the money will be quickly debited from your account when your check is converted to an e-check.

3 Tips for writing checks

A thief can alter a lost or stolen check. Checks have multiple chances of getting lost after they leave your hands, so it’s hard for a thief to give you a headache. Whether or not you’re permanently losing money, you’ll need to spend time and effort cleaning up the post-scam mess.

Safety warning

Develop the following habits to reduce the chances of your account being affected by fraud.

Make it permanent: Use a pen when writing checks. If you use a pencil, anyone with an eraser can change the amount and payee name on your check.

No Blank Checks: Do not sign the check until you have entered the payee name and amount. If you’re not sure who to write a check to or how much something will cost, just bring a pen — it’s far less risky than giving someone unlimited access to your checking account.

Stop checks from growing: When filling in dollar amounts, make sure to print the value in a way that prevents scammers from inflating it. To do this, start at the far left of the room and draw a line after the last number. For example, if your check is for $8.15, place the “8” as far to the left as possible. Then draw a line from the right of the “5” to the end of the space, or capitalize the number so that adding numbers is difficult. If you leave the room and someone can add the numbers, your check might be $98.15 or $8,159.

-

Carbon Copy: If you want a paper record of each check, get a Carbon Copy checkbook. These checkbooks contain a thin piece of paper that contains a copy of every check you write. This allows you to quickly see where your money is going and what exactly you wrote on each check.

-

Consistent signatures: Many people don’t have clear signatures, and some even sign humorous images on checks and credit card slips. However, using the same signature consistently will help you and your bank detect fraud. If the signatures don’t match, you can more easily prove that you are not responsible for any fees.

-

No “cash”: Avoid writing checks that can be withdrawn in cash. It’s as dangerous as carrying around a signed blank check or a wad of cash. If you need cash, withdraw from an ATM, buy gum and get the cash back with your debit card, or simply get cash at the counter.

-

Write fewer checks: Checks aren’t exactly risky, but there are safer ways to pay. With electronic payments, paper cannot be lost or stolen. Most checks are converted to electronic payments anyway, so you don’t shy away from this technology by using a check. Electronic payments are often easier to track because they are already in a searchable format with timestamps and payee names. Pay for recurring expenses with tools like online bill pay, and pay for everyday expenses with a credit or debit card.

Frequently Asked Questions (FAQ)

Can I write myself a check?

You can write yourself a check and deposit it at an ATM, bank branch or through your mobile banking app. Follow the procedure above and write your name in the Pay-to-Order box on the check. When depositing a check, you must endorse the back of the check.

When should I sign the check?

Do not sign the check until you have completed the Pay-to-Order section and the digital and written amounts. Signing a blank check leaves your bank account unprotected from accidental loss or theft.

POZRI TIEŽ!

Here’s an overview of the perfect check.

Here’s an overview of the perfect check.