Inflation has plagued the American economy and our wallets for months. Despite the Fed’s containment measures, many analysts predict we haven’t seen the end yet.

The consumer price index, which is used to calculate inflation, rose 8.6% in May from a year earlier, the biggest gain since 1981. The index directly measures what we need to buy every day. Includes dining, housing, clothing, transportation, medical care, entertainment, education, and communications.

“Inflation has had a major impact on the spending of many Americans,” said John Schmoll, founder of Frugal Rules, a blog focused on achieving financial freedom through frugality. “It really only takes one trip to the grocery store to see how much prices have gone up this year.”

Families are estimated to be spending at least $300 more a month on daily necessities, Schmall said. “This could have a real impact on those already living on paychecks. Worse, it could impact how much longer-term goals can be met, such as saving for retirement, big spending or other needs.”

Start with the basics

The first key to saving money is tracking your spending, says Allison Baggerly of the Inspired Budget blog. “If you don’t know where your money is going, you can’t use it to save money,” she said. Classify your expenses into groceries, gas, entertainment, and any other categories that apply. (Many different budgeting apps can help you.)

“Once you know exactly how much you’re spending, you can make informed decisions about where you can actually reduce your spending,” Bagley said.

Finding loss leaders

“There are a lot of ways to save right now, you just have to be the target,” Schmoor said. Many grocers use a pricing strategy called “loss leaders” to lure shoppers into the store with discounted prices on popular items in the hope that they will also buy higher-priced items. “Our local store, for example, sells milk for $1.99 a gallon. That’s a few dollars less than usual. I buy two gallons and keep them in our freezer for a rainy day,” Schmore said.

Cut back on streaming services

There are more streaming services than ever, it’s too easy to just sign up for a movie you want to watch and forget about it immediately because you’ll keep getting charged. “If this is you, look at the services you haven’t seen in the last month,” Schmore said. “Once you’ve identified them, cancel or suspend service until you want to see something on it. This instantly adds more money to your budget and there are no cancellation fees.”

Buy discounted gift cards

From local restaurants and movie theaters to hardware stores, auto service and airline tickets, you’ll find discounted gift cards, sometimes over 20% off. Look for gift cards on sites like Costco or Raise. “Our family does this all year round,” Schmore said. “If you’re not a Costco member, ask a friend to buy it for you.”

Understand your needs and wants

Baggerly suggests a simple exercise to determine where you want your money to go. Make a list of your expenses and prioritize them. “While society tells us every expense counts, it doesn’t,” she said. “Spend money on the most important expenses first. Add less expensive or optional outputs next. This will help you easily differentiate between your wants and needs,” she says.

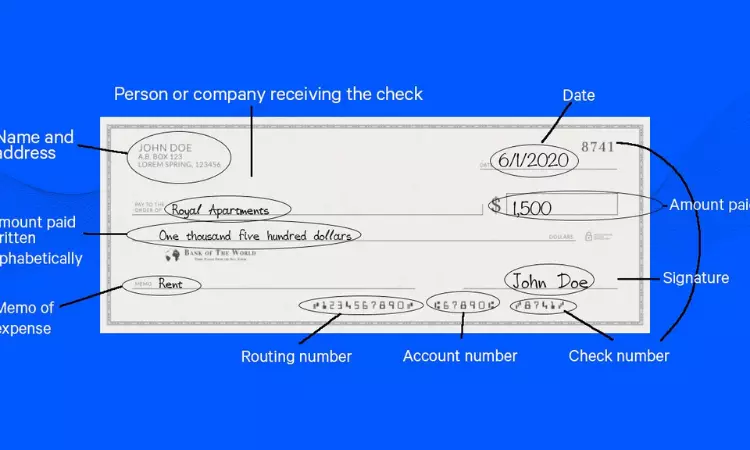

Double exam

If you need to keep an eye on your spending, one clever trick Baggerly shares is opening a second checking account. The first current account can pay for necessary expenses such as rent/mortgage, utilities, groceries and bills. A second checking account can be used for additional expenses like dining, entertainment, and summer fun. “Separating your money this way can help you keep your spending on track,” she said. “Plus, your most important expense (your bill) will be paid securely.”

Daha fazla bilgi edin:

-

-

-

-

Delta Skymiles® Reserve American Express Kart İncelemesi – Daha fazlasını görün.

-

AmEx, yeni çek hesabı ve yeniden tasarlanan uygulamayla müşteri deneyimine odaklanıyor

-

Discover it® Rewards kartı ödüllerinin nasıl çalıştığını görün