Mặc dù không còn phổ biến như trước, nhưng séc vẫn được sử dụng rộng rãi, ngay cả trong thế giới kỹ thuật số ngày nay. Séc giấy là một công cụ chuyển tiền hiệu quả và rẻ tiền, nhưng có lẽ bạn không viết séc mỗi ngày (hoặc chưa bao giờ viết séc).

Viết séc rất dễ và hướng dẫn này sẽ chỉ cho bạn cách thực hiện. Thực hiện từng bước riêng lẻ hoặc chỉ sử dụng ví dụ trên làm mẫu cho bài đánh giá bạn cần viết. Bạn có thể thực hiện các bước này theo bất kỳ thứ tự nào miễn là sản phẩm hoàn thiện không thiếu bất kỳ thông tin quan trọng nào. Trong ví dụ này, bạn sẽ di chuyển từ trên xuống dưới, điều này sẽ giúp bạn không bỏ qua bất kỳ bước nào.

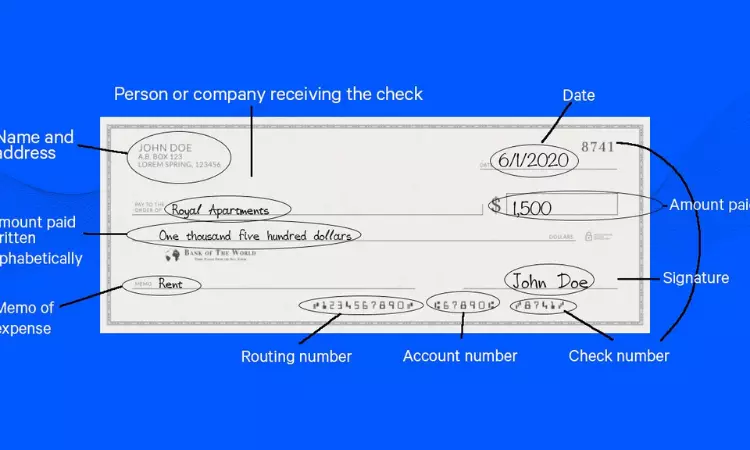

1 Ví dụ

Sau đây là tổng quan về một tấm séc hoàn hảo.

Sau đây là tổng quan về một tấm séc hoàn hảo.

1 Ngày hiện tại: được viết ở góc trên bên phải. Trong hầu hết các trường hợp, ngày hôm nay sẽ được sử dụng để giúp bạn và người nhận duy trì hồ sơ chính xác. Bạn cũng có thể ghi ngày trên séc, nhưng không phải lúc nào cũng theo ý muốn.

Người thụ hưởng thứ 2: Trong dòng “Thanh toán thay”, hãy nhập tên của người hoặc tổ chức mà bạn muốn thanh toán. Bạn có thể phải hỏi: “Tôi cần lập hóa đơn cho ai?” nếu bạn không chắc chắn nên viết gì, vì thông tin này cần phải chính xác.

Số tiền thứ 3 dưới dạng kỹ thuật số: Viết số tiền thanh toán của bạn vào ô nhỏ bên phải. Bắt đầu viết càng xa về phía bên trái càng tốt. Nếu khoản thanh toán của bạn là $8.15, số “8” phải nằm ngay bên trái hộp đô la để tránh gian lận. Xem ví dụ về cách nhập số tiền.

4. Viết số tiền bằng chữ: Viết số tiền bằng chữ để tránh gian lận và nhầm lẫn. Đây là số tiền chính thức bạn phải trả. Nếu số tiền này khác với số bạn nhập ở bước trước thì số tiền bạn nhập dưới dạng văn bản về mặt pháp lý chính là số tiền ghi trên séc của bạn. Chỉ sử dụng chữ in hoa vì chúng khó thay đổi hơn.

Chữ ký thứ 5: Ký rõ ràng vào dòng ở góc dưới bên phải của tờ séc. Sử dụng cùng tên và chữ ký với ngân hàng của bạn. Bước này rất quan trọng – những tấm séc chưa được ký đều không hợp lệ.

Dòng ghi nhớ thứ 6 (hoặc “Lời đề nghị”): Bạn có thể thêm ghi chú nếu muốn. Bước này là tùy chọn và không ảnh hưởng đến cách ngân hàng xử lý séc của bạn. Dòng bình luận là nơi tuyệt vời để nhắc nhở bản thân lý do tại sao bạn viết séc. Đây cũng có thể là nơi bạn viết thông tin mà người nhận sẽ sử dụng để xử lý khoản thanh toán của bạn (hoặc tìm tài khoản của bạn nếu có thông tin nào đó bị thất lạc). Ví dụ, nếu bạn đang nộp thuế cho IRS, bạn có thể ghi số An sinh xã hội của mình vào dòng này hoặc sử dụng số tài khoản để thanh toán hóa đơn tiện ích.

Sau khi viết séc, hãy ghi lại khoản thanh toán. Cho dù bạn sử dụng sổ đăng ký điện tử hay sổ đăng ký giấy, sổ đăng ký séc là nơi hoàn hảo để thực hiện việc này. Việc ghi lại các khoản thanh toán giúp bạn tránh phải chi tiền hai lần – số tiền sẽ tiếp tục hiển thị trong tài khoản của bạn cho đến khi séc được gửi hoặc đổi thành tiền mặt, việc này có thể mất một thời gian. Tốt nhất là bạn nên ghi ra khoản thanh toán khi đầu óc bạn tỉnh táo.

Trước khi viết séc, hãy chắc chắn rằng đó thực sự là việc bạn cần làm. Viết séc rất phức tạp và không phải là cách nhanh nhất để gửi tiền. Bạn có thể có những lựa chọn khác giúp cuộc sống của bạn dễ dàng hơn và tiết kiệm tiền. Ví dụ, bạn có thể:

-

Thanh toán hóa đơn trực tuyến và thậm chí yêu cầu ngân hàng tự động gửi séc hàng tháng. Bạn không cần phải viết séc, trả bưu phí hoặc gửi séc

-

Hãy sở hữu một thẻ ghi nợ và sử dụng nó để chi tiêu. Bạn thanh toán từ cùng một tài khoản nhưng thanh toán bằng phương thức điện tử. Bạn không phải sử dụng bất kỳ tấm séc nào (bạn phải sắp xếp lại chúng) và bạn có hồ sơ điện tử về giao dịch với tên người nhận, ngày thanh toán và số tiền.

-

Thiết lập thanh toán tự động cho các khoản thanh toán định kỳ như tiện ích và bảo hiểm. Phương thức thanh toán này thường miễn phí và giúp cuộc sống của bạn dễ dàng hơn. Chỉ cần đảm bảo bạn luôn có đủ tiền mặt trong tài khoản để thanh toán hóa đơn.

Bất kể bạn thanh toán bằng cách nào, hãy đảm bảo rằng bạn luôn có đủ tiền trong tài khoản thanh toán của mình. Nếu không, khoản thanh toán của bạn có thể bị trả lại và gây ra nhiều vấn đề, bao gồm phí cao và các vấn đề pháp lý tiềm ẩn.

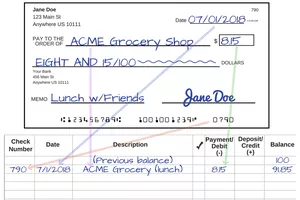

2 Ghi lại các khoản thanh toán trong sổ séc của bạn

Ghi lại mọi tấm séc bạn viết vào sổ séc. Điều này cho phép bạn:

Ghi lại mọi tấm séc bạn viết vào sổ séc. Điều này cho phép bạn:

-

Theo dõi chi tiêu của bạn để không bị mất vé.

-

Biết tiền của bạn đi đâu. Sao kê ngân hàng của bạn chỉ nên hiển thị số séc và số tiền – không cho biết bạn đã viết séc cho ai.

-

Phát hiện gian lận và trộm cắp danh tính trong tài khoản thanh toán của bạn.

Khi bạn nhận được sổ séc, bạn hẳn đã nhận được sổ séc rồi. Nếu bạn không có, bạn có thể dễ dàng tự tạo một bản bằng giấy hoặc bảng tính.

Sao chép tất cả thông tin quan trọng từ séc:

-

Kiểm tra số

-

Ngày bạn viết séc

-

Mô tả về giao dịch hoặc người mà bạn đã viết séc

-

Số tiền thanh toán là bao nhiêu?

Nếu bạn cần biết thêm thông tin chi tiết về nơi tìm thông tin này, hãy xem biểu đồ hiển thị các phần khác nhau của một tấm séc.

Bạn có thể sử dụng máy tính tiền để cân đối tài khoản vãng lai của mình. Đây là hoạt động kiểm tra lại mọi giao dịch trong tài khoản ngân hàng của bạn để đảm bảo bạn và ngân hàng hiểu rõ thông tin. Bạn sẽ biết nếu có bất kỳ lỗi nào trong tài khoản của mình và nếu có ai đó chưa gửi séc mà bạn đã viết (khiến bạn nghĩ rằng mình có nhiều tiền hơn để chi tiêu).

Sổ séc của bạn cũng cung cấp thông tin tức thời về số tiền bạn có trong tay. Sau khi viết séc, bạn nên cho rằng số tiền đã mất — trong một số trường hợp, số tiền sẽ nhanh chóng được ghi nợ từ tài khoản của bạn khi séc của bạn được chuyển đổi thành séc điện tử.

3 Mẹo viết séc

Khi viết séc, hãy đảm bảo sử dụng đúng mục đích bạn mong muốn – trả đúng số tiền bạn mong đợi cho người hoặc tổ chức mà bạn mong đợi.

Khi viết séc, hãy đảm bảo sử dụng đúng mục đích bạn mong muốn – trả đúng số tiền bạn mong đợi cho người hoặc tổ chức mà bạn mong đợi.

Kẻ trộm có thể thay đổi một tấm séc bị mất hoặc bị đánh cắp. Séc có nhiều khả năng bị thất lạc sau khi rời khỏi tay bạn, do đó, kẻ trộm khó có thể làm bạn đau đầu. Cho dù bạn có bị mất tiền vĩnh viễn hay không, bạn cũng cần phải dành thời gian và công sức để dọn dẹp hậu quả sau vụ lừa đảo.

Cảnh báo an toàn

Hãy hình thành những thói quen sau để giảm nguy cơ tài khoản của bạn bị ảnh hưởng bởi gian lận.

Làm cho nó trở nên vĩnh viễn: Sử dụng bút khi viết séc. Nếu bạn sử dụng bút chì, bất kỳ ai có cục tẩy cũng có thể thay đổi số tiền và tên người nhận trên séc của bạn.

Không có séc trống: Không ký séc cho đến khi bạn nhập tên người nhận và số tiền. Nếu bạn không chắc nên viết séc cho ai hoặc chi phí là bao nhiêu, chỉ cần mang theo một cây bút — điều này ít rủi ro hơn nhiều so với việc cho ai đó quyền truy cập không giới hạn vào tài khoản thanh toán của bạn.

Ngăn chặn sự phát triển của séc: Khi điền số tiền bằng đô la, hãy đảm bảo in số tiền theo cách ngăn chặn kẻ lừa đảo thổi phồng số tiền. Để thực hiện điều này, hãy bắt đầu từ góc trái của căn phòng và vẽ một đường thẳng sau số cuối cùng. Ví dụ, nếu séc của bạn là $8.15, hãy đặt số “8” càng xa về phía bên trái càng tốt. Sau đó vẽ một đường thẳng từ bên phải số “5” đến hết khoảng trống, hoặc viết hoa số đó để việc cộng số trở nên khó khăn. Nếu bạn rời khỏi phòng và có người thêm số, số séc của bạn có thể là $98.15 hoặc $8,159.

-

Bản sao giấy: Nếu bạn muốn có bản ghi chép giấy tờ của mỗi tấm séc, hãy lấy một cuốn sổ séc bản sao giấy. Những cuốn sổ séc này chứa một tờ giấy mỏng ghi lại bản sao của mọi tấm séc bạn viết. Tính năng này cho phép bạn nhanh chóng xem tiền của mình đã đi đâu và chính xác bạn đã viết gì trên mỗi tấm séc.

-

Chữ ký nhất quán: Nhiều người không có chữ ký rõ ràng, một số thậm chí còn ký những hình ảnh hài hước trên séc và giấy thanh toán thẻ tín dụng. Tuy nhiên, việc sử dụng cùng một chữ ký thường xuyên sẽ giúp bạn và ngân hàng phát hiện gian lận. Nếu chữ ký không khớp, bạn có thể dễ dàng chứng minh rằng bạn không phải chịu bất kỳ khoản phí nào.

-

Không có “tiền mặt”: Tránh viết những tấm séc có thể rút được bằng tiền mặt. Việc này nguy hiểm như việc mang theo một tấm séc trắng có chữ ký hoặc một cọc tiền mặt vậy. Nếu bạn cần tiền mặt, hãy rút tiền từ máy ATM, mua kẹo cao su và lấy lại tiền bằng thẻ ghi nợ hoặc chỉ cần lấy tiền mặt tại quầy.

-

Viết ít séc hơn: Séc không thực sự rủi ro, nhưng có những cách thanh toán an toàn hơn. Với thanh toán điện tử, giấy tờ không thể bị mất hoặc bị đánh cắp. Hầu hết các loại séc đều được chuyển đổi thành hình thức thanh toán điện tử, vì vậy bạn không cần ngại sử dụng công nghệ này khi thanh toán bằng séc. Thanh toán điện tử thường dễ theo dõi hơn vì chúng đã ở định dạng có thể tìm kiếm được với dấu thời gian và tên người nhận thanh toán. Thanh toán các khoản chi phí định kỳ bằng các công cụ như thanh toán hóa đơn trực tuyến và thanh toán các khoản chi phí hàng ngày bằng thẻ tín dụng hoặc thẻ ghi nợ.

Những câu hỏi thường gặp (FAQ)

Tôi có thể tự viết séc không?

Bạn có thể tự viết séc và gửi tại máy ATM, chi nhánh ngân hàng hoặc thông qua ứng dụng ngân hàng di động. Thực hiện theo quy trình trên và viết tên của bạn vào ô Thanh toán theo đơn đặt hàng trên séc. Khi gửi séc, bạn phải ký xác nhận mặt sau của séc.

Tôi nên ký séc khi nào?

Không ký séc cho đến khi bạn hoàn tất phần Thanh toán theo lệnh đặt hàng và số tiền kỹ thuật số và số tiền viết tay. Ký séc trắng sẽ khiến tài khoản ngân hàng của bạn không được bảo vệ khỏi nguy cơ mất mát hoặc trộm cắp.

XEM THÊM!