Looking for the perfect guide to Credit One Bank Login? You are in the right place.

Credit One Bank is a banking and financial services company headquartered in Las Vegas, Nevada. The company is a wholly owned subsidiary of Credit One Financial, incorporated in Nevada, as a Subchapter-S Corporation. It is also associated with Sherman Financial Group LLC through mutual beneficial ownership.

The company is primarily in the credit card business and has more than 10 million cardholders in the United States. Credit One Bank was originally established on July 30, 1984 in San Rafael, California as First National Bank of Marin, abbreviated (FNBM).

Before concentrating all activity on partially and fully guaranteed credit cards (FNBMs), it had a wide range of products. In 1998, the bank moved from San Rafael, California to Las Vegas, Nevada.

After obtaining CEBA status in March 2005, the bank officially changed its name to Credit One Bank, N.A. on February 1, 2006. In this day and age, maintaining good credit is a daunting task.

The tools used to measure credit card scores have become more advanced over time. While the possibility of using multiple credit cards for credit card maintenance and improvement is under consideration may sound far-fetched, surprisingly, it works.

If you’ve been worrying about your credit score and trying to find ways to improve it, we’ve got you covered: Credit One Bank. As mentioned earlier in this article, Credit One Bank focuses on credit cards while also helping to improve your credit score by timely data entry of your contributions to 3 credit score databases.

In addition to these services and facilities, Credit One Bank offers many other professional services and benefits when you sign up.

Credit One Bank is known for providing user-friendly and technologically advanced services through its mobile application, which runs on both Android and IOS systems, providing users with current and updated information about their accounts and various activities related to them . So let’s start with Credit One bank login, bank account creation, pros and cons.

Credit One Bank Login Guide 2022 [Full Guide]

How do I create a Credit One bank account?

There are two ways to create a new Credit One bank account:

Email invitation

If you have a low credit score, there is a good chance you will receive an invitation email from Credit One Bank. This email promotes and discusses the services offered by Credit One Bank.

If you have received such an email, you should visit Credit One Bank’s official website, the link may be included in the email itself. Click on the “Accept Email Quote” option that appears at the top of the web page.

You can also click on the menu icon and select the same options visible there. The next step is to enter your License Card and Postal Code, then click on the Continue option and follow further instructions on the website.

Website

If you do not receive any emails from Credit One Bank, you can create your account yourself through Credit One Bank’s official website or write to the bank yourself.

You need to visit the official Credit One Bank website using the browser of your choice. Next, find “See if you are prequalified” on the webpage, select a card and continue.

Now you need to provide your basic personal information to the website to get started. This information is important because based on the information you provide, you will qualify as a cardholder.

If you are eligible, you can now easily apply for the card acceptance process. If you do not complete this step, you will need to write a formal application to the bank and send it by email or post, whichever you prefer.

Credit One Bank Login Guide

One of the greatest benefits of using and opening an account with Credit One Bank is the ability to create and manage an online account using its Android or IOS mobile app.

With the help of Credit One Bank, online account users can track the activities that take place through their accounts; in particular, this feature helps detect fraudulent activity on their accounts before it is too late.

Pay all bills and charges on time, view bank statements and easily manage activity on your account. Below are the steps you need to follow to open an online account with Credit One Bank. Proceed as follows:

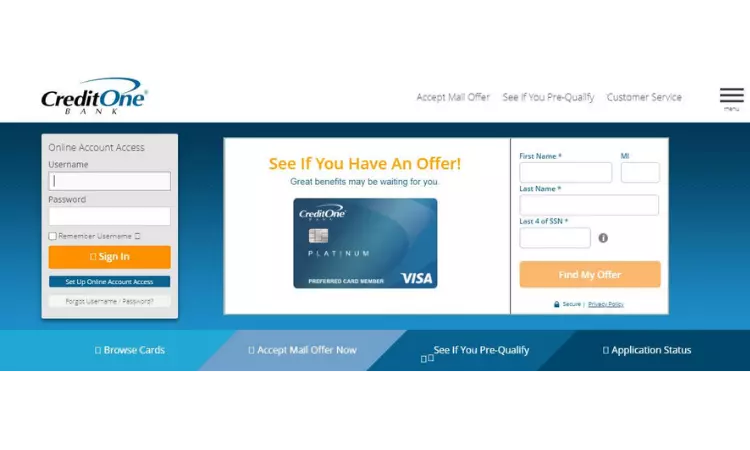

- Use your browser to visit Credit One Bank’s official website, creditonebank.com.

- Once on the Credit One Banks website, look for the “Online Account Access” option, under which you will find the “Set Up Online Account Access” tab, colored blue.

- After clicking the tab, you will be redirected to a new page where you need to fill in some information.

- The required information includes your card number, expiration date, security code, and your social security number.

After filling in the information, click the “Next” option. - Next, you will need to enter some basic information such as your user ID and password; both will be useful for all your future logins at Credit One Bank. After filling in the information, click the “Next” option.

- After filling in the information, click the “Next” option.

- Next, you will need to enter some basic information such as your user ID and password; both will be useful for all your future logins at Credit One Bank.

- After filling in the information, click the “Next” option.

- Next, you need to create some security questions to add extra protection to your online account with Credit One Bank. This step is essential to keep hackers away from your account.

- The next step is to log into your online Credit One bank account and sign your User ID and Password. If this is your first time doing this step, you will need to verify your identity using an OTP, which will be sent to your bank registered phone number and email address.

也可以看看!

- 美國運通百夫長黑卡評論

- X1信用卡 – 查看如何申請。

- Destiny 信用卡 – 如何在線上訂購。

- 達美「飛凡哩程常客計畫」儲備美國運通卡評論 – 查看更多。

- 美國運通透過新的支票帳戶和重新設計的應用程式專注於客戶體驗

Benefits of Using a Credit One Bank Online Account

- Credit One Bank provides the best security to its users because the bank’s systems are technologically advanced and they are highly committed to protecting the privacy of their customers.

- With the mobile app, you can easily spot any fraudulent activity or theft through your account. It provides you with real-time information on activity related to your account.

- The mobile app alerts users when suspicious activity occurs through their account, e.g. B. if someone tries to hack into your account from another device.

- The EVM chip technology used in the cards offered by Credit One Bank helps prevent counterfeiting.

- Customers’ personal information is secured using state-of-the-art technology.

- By using Credit One Bank’s various services and its credit cards, customers can take advantage of the many rewards and cashbacks offered by its loyal users. With a Credit One Bank credit card, you can get up to 5% cash back on your payments. Every Credit One Bank credit card has a special rewards system, so there is something for every customer.

- You can improve your credit score with Credit One Bank credit cards because they are designed for customers with low credit scores who are looking for ways to improve. Credit One Bank can help improve your customers’ credit scores by updating 3 key databases that are typically used to calculate your credit score every time you pay the bank a fee. The high interest rates paid might offend some customers, but the high rates forced customers to pay early, ultimately improving their credit scores. Banks also provide details of their customers’ Experian credit scores in monthly summaries, explaining to customers how credit scores have changed over time and the factors driving that change.

- Credit One Bank believes in providing customers with a highly personalized service to help build long-term relationships with customers. For a minimal additional fee, customers have the freedom and opportunity to choose a card design for themselves. Notifications that customers receive from their banks can be prioritized by importance so they don’t miss a thing. In addition to all these services, customers can also choose the payment due date.

- You can use the Credit One Bank online mobile app to manage your account, pay fees and check your credit score to keep track of all your account activity anytime, anywhere.

Disadvantages of using a credit-bank online account

- The Credit One Bank credit card is designed for people with low credit scores and looking to improve their credit scores, and working with such customers is risky for the bank. It is for this reason that banks charge customers higher interest rates on all late payments. Due to a strong credit rating, customers are motivated to pay on time, which ultimately helps build the customer’s credibility in return.

- Some Credit One banks have annual fees as low as $0, but their annual fees are split into monthly payments. Some of the Credit One Bank credit cards have an annual fee of up to $99. The real issue is the volatility of the annual fee charged by Credit One Bank. This annual fee depends on your creditworthiness; if you have a low credit score, you will be charged a high annual fee, and vice versa. In addition to the annual fee, the monthly fee also annoys some customers because, as a common assumption, customers may think that if they don’t use their credit card bill for a month, they don’t have to pay their credit card bill. Instead, customers must pay an annual fee as well as fees for late payments.

- Credit One Back offers a maximum cashback rate of 5%, and there are other credit card companies in the US willing to offer customers even more cashback. Credit One Bank claims that their credit card is specially designed for people looking to improve their credit score. They don’t necessarily have to appeal to a target market looking for flashy rewards and offering programs that come with credit cards.

- For all foreign transactions, there is a 3% fee per transaction; this even applies to foreign online stores. So if you’re traveling abroad, many Credit One Bank credit cards aren’t ideal for you.

Last words

We hope this article was helpful and we were able to clear any doubts you had about the Credit One Bank login background information and handy login guide. The process is simple and the Credit One Bank website and mobile app are very user friendly, making the process easy and smooth for Credit One Bank customers.

也可以看看!

- 美國運通百夫長黑卡評論

- X1信用卡 – 查看如何申請。

- Destiny 信用卡 – 如何在線上訂購。

- 達美「飛凡哩程常客計畫」儲備美國運通卡評論 – 查看更多。

- 美國運通透過新的支票帳戶和重新設計的應用程式專注於客戶體驗