With a large branch network and a wide range of products, Chase is often considered the most important banking institution in the country.

What we like

- Chase has more than 4,700 branches and 16,000 ATMs.

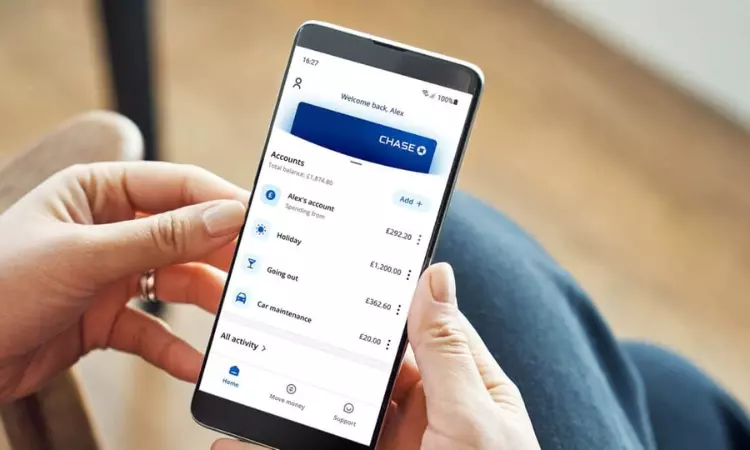

- The bank’s website and mobile app have consistently received high marks.

- Chase often rewards new customers with bonuses for opening an account.

We have nothing

- Chase’s savings accounts and certificates of deposit have very low interest rates.

- Banks charge $2.50 for off-net ATMs.

- Chase’s Basic Account does not refund out-of-network ATM fees.

There are no minimum deposit requirements to open a Chase Master Checking Account. The account does not earn interest. There is also a monthly service fee of $12, but there are a few ways to waive it:

- Set up direct deposits totaling $500 or more per month.

- Maintain an average daily balance of $5,000 in this account and associated qualifying deposit/investment accounts.

Chase customers have access to over 16,000 ATMs. The bank charges a $2.50 fee when using an out-of-network ATM.

Customers can earn interest on their Chase Premier Plus checking account, although the interest rate is negligible. However, this account allows customers to waive non-Chase ATM fees four times per billing cycle. Plus, the bank waives cheque fees among other benefits. The account’s $25 monthly service fee waives any combination of this account and related qualifying deposits/investments for a minimum of $15,000.

What we like

- There are no minimum requirements to open a total current account.

- Easily meet the requirement to waive the $12 monthly service fee.

- Chase regularly offers opening bonuses for its checking accounts.

We have nothing

- Banks charge $2.50 for off-net ATMs.

Chase savings account rates are well below the national average, and all balances receive the same APY. Especially with online banking, customers should be able to easily find savings accounts that pay higher returns. This account does not require a minimum balance. It charges a monthly service fee of $5, but customers can take some manageable steps to waive the fee, such as: B. Maintain a daily balance of $300.

For customers with a “primary” relationship with a bank, Chase Premier Savings accounts have slightly higher rates of return, but are also well below the national average. To receive Premier rates, customers must link their account to a Chase Premier Plus checking account or a Sapphire checking account and make at least five transactions from the linked checking account during a monthly billing cycle.

Chase sometimes offers bonuses to new customers who open savings accounts, though most of its bonuses go to new checking customers and can add up to hundreds of dollars.

What we like

The monthly fee is waived if the customer meets one of several manageable requirements.

There is no minimum balance requirement.

We have nothing

Both savings accounts have very low returns.

Clients must take steps monthly to earn (still low) APY for premium relationships.

Chase customers have access to up to 14 CDs of varying maturities. (Product availability may vary by location.) Banks also offer CDs with unique maturities, such as B. Three, nine, and fifteen months. Term varies from one month CD to 10 years. A minimum deposit of $1,000 is required per CD.

Customers who deposit larger amounts into CDs may get slightly higher rates, but still lower than the national average.

What we like

- Chase provides a wide range of CD terminology.

- Open for as little as $1,000 per CD.

We have nothing

- Chase’s CD prices are very low.

- Higher rates for higher grades are also lower than the national average.

Banking experience

Chase provides access to more than 4,700 locations and 16,000 Chase ATMs. You can access a mobile app that greets you based on your location. You can send money and pay bills to anyone.

You can also speak to a Chase representative 24 hours a day.

Chase offers to help Chase checking account holders make money by using their debit cards at certain merchants.

Chase customers can pay and receive money from others via their mobile phones.

Chase credit cards are loved for their value and versatility, including the option to redeem rewards for added value through the Chase Ultimate Rewards portal. The best Chase credit card is the Chase Sapphire Preferred® Card, which offers great sign-up bonuses in addition to premium travel rewards and perks

About Chase Bank

Chase Bank is the consumer banking arm of JPMorgan Chase, one of the largest banking groups in the United States. Chase offers a full range of banking services including checking, savings, money market accounts and CDs. The bank, which dates back to 1799, has grown through several major mergers over the years, including with Bank One Corp. In 2004, and in 2008 acquired the deposits and most of the assets of the failed Washington Mutual Bank. Chase is aggressively expanding its retail banking business. The bank is expanding to open 400 branches in new markets.

If you like quick access to branches and ATMs — and live where banks operate — Chase is an obvious choice. If you’re looking for great prices or want to be able to use the first ATM you see without paying hefty off-net fees, look elsewhere.

Learn more:

-

-

-

-

Delta Skymiles® Reserve American Express Card Review – See more.

-

AmEx focuses on customer experience with new checking account and redesigned application

-