Learn about Visa and Mastercard

Visa and Mastercard are the only online payment processors operating in all three segments of the payments market. Working strictly as network processors, the two companies have unique advantages, but they work differently.

Both Visa and Mastercard are publicly traded. Visa (trading symbol V) has a market capitalization of $497.5 billion, while Mastercard (trading symbol MA) is close behind with $359.8 billion (market capitalization as of May 18, 2021).

Since neither company offers credit cards or card issuance services through the banking sector, both companies have extensive co-branded product portfolios.

The business models of the two companies are very similar. Visa and Mastercard do not issue cards directly to the public, but rather through partner financial institutions such as banks and credit unions. Member financial institutions then issue cards to individuals and businesses, either directly or in partnership with airlines, hotels or retail brands.

Set general terms and conditions

The issuing financial institution sets the terms and conditions of the payment card, including fees, rewards and other features. (Merchants often work with third-party financial institutions.) For credit cards, the issuer is responsible for the underwriting, rate structure, and full development of the rewards program.

Card issuers may also offer other benefits such as: B. Protection against identity theft and fraud, car rental insurance and discounts on business purchases. While differences in interest rates, credit limits, rewards programs and benefits are controlled by the card-issuing financial institution, Visa and Mastercard compete for co-branding relationships and are involved in setting the card terms.

Overall, the card payments industry is complex, including merchants, merchant acquiring banks, card issuers, network processing and cardholders. Network processors, especially Mastercard and Visa, are free to arrange fees as they see fit. This structuring and reporting is one of the main differences between the two largest network processors.

Visa Card Overview

In 2020, Visa had $21.8 billion in net sales and $8.8 trillion in payments. Visa’s core products include credit, debit and prepaid cards, as well as business solutions and global ATM services. The company’s reportable business segments include:

- Service ($9.8 billion in 2020)

- International Transactions ($6.3 billion in 2020)

- Data Processing ($11.0 billion in 2020)

- Other ($1.4 billion in 2020)

Visa and Mastercard generate most of their revenue from service and data processing fees, but the two companies describe these fees differently and have their own fee structures. The service fee is charged to the card issuer and is based on the number of cards.

Data processing fees are also typically charged to issuers, who in turn recoup these fees by charging merchants a per-transaction fee. Data processing fees are typically very small flat fees charged per transaction, including the cost of providing transaction information transmitted over the network.

Generally, Visa is known for offering three tiers of cards: traditional, signature, and unlimited. These categories include standardized provisions for issuers.

Mastercard Overview

In 2020, Mastercard made $6.3 trillion in payments with a total net income of $15.3 billion. Mastercard’s core products include consumer credit, consumer debit, prepaid and commercial products businesses. Mastercard has a reportable business unit, called Payment Solutions, divided by region in the U.S. and other countries.

Like Visa, Mastercard generates most of its revenue from service and data processing fees. However, it describes the fees differently. Mastercard service fees are negotiated as a percentage of global dollar transaction volume. The data processing fee, known as an “interchange fee,” is a small fixed cost charged to the issuer per transaction.

Mastercard is known for offering three tiers of cards: Standard, World and World Elite.

¡VER TAMBIÉN!

- Revisión de la tarjeta American Express Centurion Black

- Tarjeta de Crédito X1 – Consulta cómo solicitarla.

- Tarjeta de crédito Destiny: cómo realizar pedidos en línea.

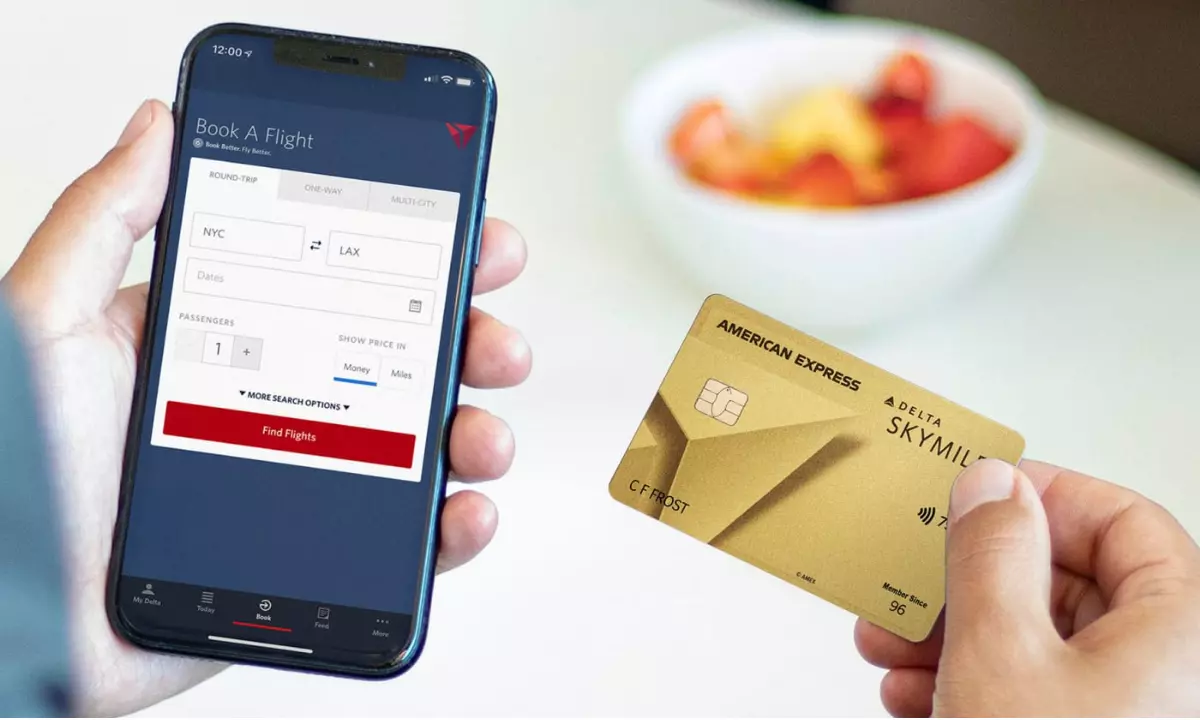

- Revisión de la tarjeta Delta Skymiles® Reserve American Express - Ver más.

- American Express se centra en la experiencia del cliente con una nueva cuenta corriente y una aplicación rediseñada

- Recompensas de la tarjeta Discover it® Rewards vea cómo funciona