Tražite savršen vodič za prijavu u Credit One Bank? Na pravom ste mjestu.

Credit One Bank je tvrtka za bankarske i financijske usluge sa sjedištem u Las Vegasu, Nevada. Tvrtka je podružnica u potpunom vlasništvu Credit One Financial, osnovane u Nevadi, kao Subchapter-S Corporation. Također je povezan sa Sherman Financial Group LLC kroz zajedničko stvarno vlasništvo.

Tvrtka se prvenstveno bavi poslovanjem s kreditnim karticama i ima više od 10 milijuna vlasnika kartica u Sjedinjenim Državama. Credit One Bank izvorno je osnovana 30. srpnja 1984. u San Rafaelu u Kaliforniji kao First National Bank of Marin, skraćeno (FNBM).

Prije koncentriranja svih aktivnosti na djelomično i potpuno zajamčene kreditne kartice (FNBM), imala je široku paletu proizvoda. Godine 1998. banka se preselila iz San Rafaela u Kaliforniji u Las Vegas u Nevadi.

Nakon dobivanja CEBA statusa u ožujku 2005., banka je službeno promijenila ime u Credit One Bank, NA 1. veljače 2006. U današnje vrijeme održavanje dobre kreditne sposobnosti je zastrašujući zadatak.

Alati koji se koriste za mjerenje rezultata kreditnih kartica vremenom su postali napredniji. Iako se razmatra mogućnost korištenja više kreditnih kartica za održavanje i poboljšanje kreditne kartice može zvučati nategnuto, iznenađujuće, funkcionira.

Ako ste brinuli o svom kreditnom rezultatu i pokušavali pronaći načine da ga poboljšate, mi smo za vas: Credit One Bank. Kao što je ranije spomenuto u ovom članku, Credit One Bank usredotočuje se na kreditne kartice, a istovremeno pomaže poboljšati vašu kreditnu sposobnost pravovremenim unosom podataka o vašim doprinosima u 3 baze podataka o kreditnoj sposobnosti.

Uz ove usluge i pogodnosti, Credit One banka nudi mnoge druge profesionalne usluge i pogodnosti kada se prijavite.

Credit One banka poznata je po pružanju jednostavnih i tehnološki naprednih usluga putem svoje mobilne aplikacije, koja radi na Android i IOS sustavima, dajući korisnicima aktualne i ažurirane informacije o njihovim računima i raznim aktivnostima vezanim uz njih. Pa počnimo s prijavom u Credit One banku, stvaranjem bankovnog računa, prednostima i manama.

Vodič za prijavu na Credit One Bank 2022. [Cjeloviti vodič]

Kako mogu otvoriti Credit One bankovni račun?

Postoje dva načina za kreiranje novog bankovnog računa Credit One:

Pozivnica e-poštom

Ako imate nizak kreditni rezultat, postoji dobra šansa da ćete primiti pozivnicu e-poštom od Credit One Bank. Ova e-poruka promiče i govori o uslugama koje nudi Credit One Bank.

Ako ste primili takvu e-poruku, trebali biste posjetiti službenu web stranicu Credit One Bank, poveznica se može nalaziti u samoj e-poruci. Kliknite na opciju "Prihvati ponudu putem e-pošte" koja se pojavljuje na vrhu web stranice.

Također možete kliknuti na ikonu izbornika i odabrati iste opcije koje su tamo vidljive. Sljedeći korak je unos vaše licencne kartice i poštanskog broja, zatim kliknite na opciju Nastavi i slijedite daljnje upute na web stranici.

Web stranica

Ako ne primate nikakve e-poruke od Credit One Banke, možete sami kreirati svoj račun putem službene web stranice Credit One Banke ili sami pisati banci.

Morate posjetiti službenu web stranicu Credit One banke koristeći preglednik po vašem izboru. Zatim pronađite "Provjerite jeste li pretkvalificirani" na web stranici, odaberite karticu i nastavite.

Sada web stranici morate dati svoje osnovne osobne podatke da biste započeli. Ove informacije su važne jer se na temelju informacija koje navedete kvalificirate kao vlasnik kartice.

Ako ispunjavate uvjete, sada se možete jednostavno prijaviti za postupak prihvaćanja kartice. Ako ne dovršite ovaj korak, morat ćete napisati službeni zahtjev banci i poslati ga e-poštom ili poštom, kako god želite.

Vodič za prijavu na Credit One Bank

Jedna od najvećih prednosti korištenja i otvaranja računa u Credit One banci je mogućnost kreiranja i upravljanja online računom pomoću mobilne aplikacije za Android ili IOS.

Uz pomoć Credit One Bank korisnici online računa mogu pratiti aktivnosti koje se odvijaju preko njihovih računa; posebno, ova značajka pomaže u otkrivanju prijevarne aktivnosti na njihovim računima prije nego što bude prekasno.

Platite sve račune i troškove na vrijeme, pregledajte bankovne izvode i jednostavno upravljajte aktivnostima na svom računu. U nastavku su navedeni koraci koje morate slijediti kako biste otvorili online račun u Credit One banci. Postupite na sljedeći način:

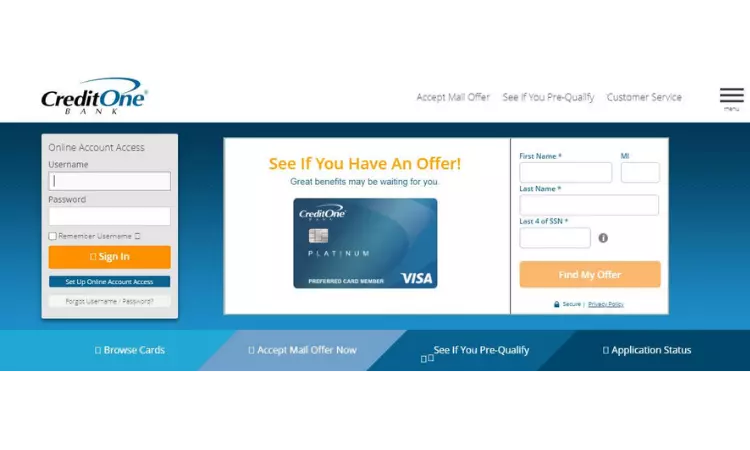

- Upotrijebite svoj preglednik kako biste posjetili službenu web stranicu Credit One banke, creditonebank.com.

- Kada dođete na web stranicu Credit One Banks, potražite opciju "Online Account Access" ispod koje ćete pronaći karticu "Set Up Online Account Access", obojenu plavom bojom.

- Nakon klika na karticu, bit ćete preusmjereni na novu stranicu gdje trebate ispuniti neke podatke.

- Potrebni podaci uključuju broj vaše kartice, datum isteka, sigurnosni kod i broj socijalnog osiguranja.

Nakon popunjavanja podataka kliknite na opciju “Dalje”. - Zatim ćete morati unijeti neke osnovne podatke kao što su vaš korisnički ID i lozinka; oba će biti korisna za sve vaše buduće prijave u Credit One Bank. Nakon popunjavanja podataka kliknite na opciju “Dalje”.

- Nakon popunjavanja podataka kliknite na opciju “Dalje”.

- Zatim ćete morati unijeti neke osnovne podatke kao što su vaš korisnički ID i lozinka; oba će biti korisna za sve vaše buduće prijave u Credit One Bank.

- Nakon popunjavanja podataka kliknite na opciju “Dalje”.

- Zatim morate postaviti neka sigurnosna pitanja kako biste dodali dodatnu zaštitu svom online računu kod Credit One Bank. Ovaj je korak neophodan kako biste hakere držali podalje od svog računa.

- Sljedeći korak je prijava na vaš internetski bankovni račun Credit One i prijava sa svojim korisničkim ID-om i lozinkom. Ako vam je ovo prvi put da radite ovaj korak, morat ćete potvrditi svoj identitet pomoću OTP-a, koji će biti poslan na vaš bankovni telefonski broj i adresu e-pošte.

VIDI TAKOĐER!

- Pregled American Express Centurion crne kartice

- X1 kreditna kartica – provjerite kako se prijaviti.

- Kreditna kartica Destiny – Kako naručiti online.

- Pregled kartice Delta Skymiles® Reserve American Express – Pogledajte više.

- American Express se usredotočuje na korisničko iskustvo s novim tekućim računom i redizajniranom aplikacijom

Prednosti korištenja internetskog računa Credit One Bank

- Credit One banka svojim korisnicima pruža najbolju sigurnost jer su sustavi banke tehnološki napredni i vrlo su predani zaštiti privatnosti svojih klijenata.

- S mobilnom aplikacijom možete lako uočiti bilo kakvu prijevarnu aktivnost ili krađu putem svog računa. Pruža vam informacije u stvarnom vremenu o aktivnostima vezanim uz vaš račun.

- Mobilna aplikacija upozorava korisnike kada se na njihovom računu dogodi sumnjiva aktivnost, npr. B. ako netko pokuša hakirati vaš račun s drugog uređaja.

- Tehnologija EVM čipa koja se koristi u karticama koje nudi Credit One Bank pomaže u sprječavanju krivotvorenja.

- Osobni podaci kupaca zaštićeni su najsuvremenijom tehnologijom.

- Korištenjem različitih usluga Credit One banke i njezinih kreditnih kartica, klijenti mogu iskoristiti brojne nagrade i povrate novca koje nude njezini vjerni korisnici. S kreditnom karticom Credit One Bank možete dobiti povrat do 5% gotovine na svoja plaćanja. Svaka kreditna kartica Credit One banke ima poseban sustav nagrađivanja, tako da se za svakog kupca može naći nešto.

- Možete poboljšati svoj kreditni rezultat s kreditnim karticama Credit One Bank jer su one namijenjene korisnicima s niskim kreditnim rezultatom koji traže načine za poboljšanje. Credit One Bank može pomoći poboljšati kreditne rezultate vaših klijenata ažuriranjem 3 ključne baze podataka koje se obično koriste za izračun vaše kreditne sposobnosti svaki put kada banci platite naknadu. Visoke plaćene kamatne stope mogle bi uvrijediti neke klijente, ali visoke stope prisilile su kupce na rano plaćanje, što je u konačnici poboljšalo njihov kreditni rezultat. Banke također daju pojedinosti o Experian kreditnim rezultatima svojih klijenata u mjesečnim sažecima, objašnjavajući klijentima kako su se kreditni rezultati mijenjali tijekom vremena i faktore koji potiču tu promjenu.

- Credit One Bank vjeruje u pružanje visoko personaliziranih usluga klijentima kako bi pomogla u izgradnji dugoročnih odnosa s klijentima. Uz minimalnu dodatnu naknadu korisnici imaju slobodu i mogućnost odabira dizajna kartice za sebe. Obavijesti koje klijenti primaju od svojih banaka mogu se poredati po važnosti kako ništa ne bi propustili. Osim svih ovih usluga, korisnici mogu odabrati i rok dospijeća plaćanja.

- Možete koristiti internetsku mobilnu aplikaciju Credit One Bank za upravljanje svojim računom, plaćanje naknada i provjeru kreditne sposobnosti kako biste pratili sve aktivnosti na svom računu bilo kada i bilo gdje.

Nedostaci korištenja internetskog računa kreditne banke

- Kreditna kartica Credit One Bank namijenjena je osobama s niskim kreditnim rezultatima koji žele poboljšati svoje kreditne rezultate, a rad s takvim klijentima je riskantan za banku. Upravo iz tog razloga banke klijentima zaračunavaju veće kamate na sva kašnjenja u plaćanju. Zbog snažnog kreditnog rejtinga, kupci su motivirani da plaćaju na vrijeme, što u konačnici pomaže u izgradnji vjerodostojnosti korisnika zauzvrat.

- Neke Credit One banke imaju godišnje naknade od čak $0, ali njihove su godišnje naknade podijeljene u mjesečne isplate. Neke od kreditnih kartica Credit One banke imaju godišnju naknadu do $99. Pravi problem je volatilnost godišnje naknade koju naplaćuje Credit One Bank. Ova godišnja naknada ovisi o vašoj kreditnoj sposobnosti; Ako imate nizak kreditni rezultat, bit će vam naplaćena visoka godišnja naknada i obrnuto. Osim godišnje naknade, nekim kupcima smeta i mjesečna naknada jer, kao uobičajena pretpostavka, korisnici mogu misliti da ako mjesec dana ne koriste račun za kreditnu karticu, ne moraju platiti račun za kreditnu karticu. Umjesto toga, kupci moraju platiti godišnju naknadu kao i naknade za zakašnjela plaćanja.

- Credit One Back nudi maksimalnu stopu povrata novca od 5%, a postoje i druge tvrtke koje izdaju kreditne kartice u SAD-u spremne ponuditi klijentima još više povrata novca. Credit One Bank tvrdi da je njihova kreditna kartica posebno dizajnirana za ljude koji žele poboljšati svoj kreditni rezultat. Ne moraju nužno privući ciljano tržište koje traži sjajne nagrade i nudi programe koji dolaze s kreditnim karticama.

- Za sve inozemne transakcije postoji naknada od 3% po transakciji; to se čak odnosi i na strane online trgovine. Dakle, ako putujete u inozemstvo, mnoge kreditne kartice Credit One banke nisu idealne za vas.

Posljednje riječi

Nadamo se da je ovaj članak bio od pomoći i da smo uspjeli riješiti sve nedoumice koje ste imali u vezi s pozadinskim informacijama za prijavu na Credit One Bank i praktičnim vodičem za prijavu. Proces je jednostavan, a web-mjesto i mobilna aplikacija Credit One Bank vrlo su jednostavne za korisnike, čineći proces lakim i glatkim za klijente Credit One Bank.

VIDI TAKOĐER!

- Pregled American Express Centurion crne kartice

- X1 kreditna kartica – provjerite kako se prijaviti.

- Kreditna kartica Destiny – Kako naručiti online.

- Pregled kartice Delta Skymiles® Reserve American Express – Pogledajte više.

- American Express se usredotočuje na korisničko iskustvo s novim tekućim računom i redizajniranom aplikacijom