Citizens Bank is the 15th largest banking institution in the United States by assets, according to the Federal Reserve. Founded in 1828, it is also one of the oldest banks in the country. Citizens Bank operates primarily on the East Coast, with offices in the Midwest as well. The bank offers a full range of bank accounts and services and is one of the largest student loan institutions in the United States.

Some Citizens Bank product details, pricing and fee information may vary by location. For this review, we used the bank’s headquarters in Providence, Rhode Island.

This review focuses on Citizens Bank’s personal banking services. Account details and Annual Percentage Return (APY) as of June 29, 2022.

Account Basics

Take an exam

Citizens Bank offers four checking accounts to meet the needs of different customers.

Deposit check

One Deposit Checking is a basic checking account with checking privileges and a free debit card. The account has a monthly maintenance fee of $9.99, which is waived by depositing (any amount) during the billing period. There is no minimum balance requirement for a deposit check.

Citizen Discovery Review

This interest-bearing checking account currently pays 0.02% APR on all account balances. This account is available through Citizens Bank for clients with linked investment accounts. It also provides relationship benefits such as B. No fees for using an off-net ATM (though the ATM owner may still charge a fee), no fees for personal checks, stop payments, money orders, wire transfers, etc.

Citizens Quest Checking has a monthly fee of $25, which is waived on a total deposit of $5,000 per billing cycle or a combined monthly deposit and investment balance of $25,000 through a linked Citizens Bank account.

Citizen Wealth Verification

Citizens Wealth Checking is a premium checking account for individuals who want exclusive banking benefits and access to a team of financial professionals. There is no monthly maintenance fee for the account, but account holders must hold a monthly deposit and investment balance of $200,000 to qualify for the wealth test. In addition to the same benefits as Quest Checking, the main benefit of Citizens Wealth Checking is access to financial planning services and preferential interest rates on deposit accounts and loan products. Citizens Wealth Checking currently earns 0.02% APY on all balances.

Student control

Student Checking is available to customers under the age of 25. There is no monthly account maintenance fee for this checking account. You can also use an out-of-network ATM without Citizens Bank charges (though the ATM owner may still charge a fee). Another benefit of a student checking account is that there are never any overdraft fees and no overdraft protection plan fees available.

Savings

Similar to checking accounts, Citizens Bank also offers several savings accounts.

Civic savings

The Citizens Wealth Savings Account is linked to the Citizens Wealth Checking Account and there is no monthly fee. As with checking accounts, you earn 0.02% APY on all account balances. Another benefit you’ll enjoy as a Citizens Wealth customer is a refund of up to $10 in out-of-network ATM fees charged by ATM owners.

Currency market

Citizens Bank offers three money market accounts.

Personal money market

The annual interest rate on all balances in personal money market accounts is 0.01%. The account has a monthly maintenance fee of $10, which is waived if you maintain a minimum daily balance of at least $2,500. The account comes with debit card and check write access.

Deposit savings

This is the basic savings account of Citizens Bank. One Deposit Savings requires only one deposit (any amount) per billing cycle to avoid the $4.99 monthly maintenance fee. There is no monthly fee for account holders under the age of 25 or over the age of 65.

Unfortunately, the account’s annual interest rate of just 0.01% is on par with most local and regional banks, but well below the best online savings accounts.

Citizens Explore Savings

This savings account is free as it is linked to the Citizens Quest checking account. The account has an annual interest rate of 0.02%, so you won’t earn much by putting your money in Citizens Bank.

Citizens explore money markets

This is another interest-bearing account that you can pair with your Citizens Quest checking account. There are no monthly maintenance fees and it enjoys the same benefits as Citizens Quest customers. The account has a slightly higher interest rate than Citizens’ other deposit accounts, with 0.03% APR on all balances. Customers who open a new Citizens Quest Money Market account and fund it with $25,000 in new funds from a linked external account will receive a preferential rate of 0.05% APY on balances of $25,000 or more.

Citizen Wealth Money Market

This money market account is only available to Citizens Wealth customers and offers the same benefits as other wealth accounts. The annual interest rate on all balances in Citizens Wealth money market accounts is 0.04%. Opportunity to receive a prime interest rate of 0.05% APY on balances of $25,000 or more by funding your account with new funds not already in your Citizens Bank account.

CD

Citizens Bank has standard Certificates of Deposit (CD) with three tenors: 10 months, 14 months and 25 months. According to the bank’s personal deposit account fees and features guidelines, there are other CD terms available, but it’s unclear if this requires an in-person application at a local branch. None of its terms offer competitive CD prices compared to online banks.

The online-only 14-month CD pays the same 0.03% APY on all balances and all customers. Citizens Quest and Citizens Wealth customers earn relationship rates on CDs, currently 0.03% APY (same as standard rate) for 10-month CDs and 0.05% for 25-month CDs.

The minimum deposit requirement to open a CD is $1,000.

The bank also offers two other types of CDs – Fragile CDs and IRA CDs. Fragile CDs have a term of 3 to 60 months with a minimum deposit of $10,000. This type of CD allows you to withdraw funds in one go without penalty, as long as you reach the required minimum balance. IRA CDs require a minimum deposit of $250 and are subject to IRS tax rules and penalties. They have multiple terms ranging from 1 month to 120 months.

Other Accounts and Services

In addition to personal deposit accounts, Citizens Bank offers the following financial products and services:

- Credit cards

- IRAs

- Mortgage loans

- Home Equity Lines of Credit (HELOCs)

- Mortgage refinancing

- Auto loans

- Student loan refinancing

- Private student loans

- Investing and wealth management services.

Salient features

Citizens Checkup is a free service offered to all Citizens Bank customers. This free tool connects you with Citizens bankers and advisors who can assess your needs and help you develop a long-term financial plan, including retirement planning. Citizenship medical appointments are made in person at a local branch or over the phone.

Access anytime, anywhere

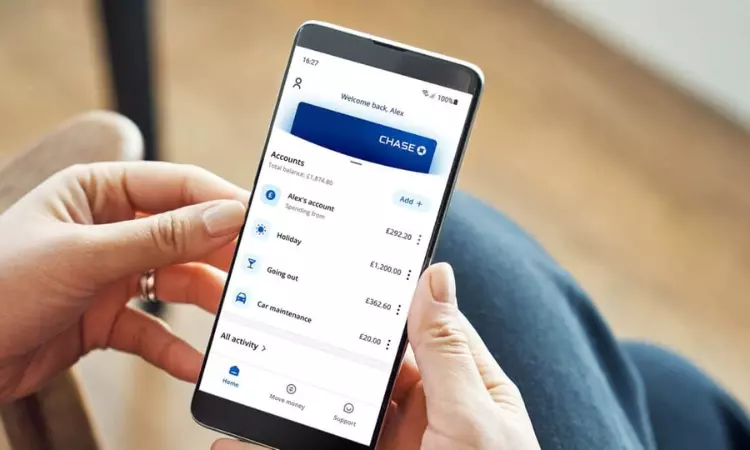

You can manage your Citizens Bank account online or through the bank’s mobile app, available for iOS (4.6 stars out of 5) or Android (4.2 stars out of 5). Through the app, Citizens Bank customers can:

- Manage bank accounts

- Deposit check

- Debit

- Pay bills

Current customers can access phone support at 1-800-922-9999, Monday through Friday, 7:00 a.m. to 10:00 p.m. EST, Saturday and Sunday, 9AM-6PM ET. To open a new account, you can call 1-800-360-2472 during the same business hours. You can also get support via live chat on the bank’s website.

Advantage

- Monthly fees for simple savings and checking accounts can easily be waived

- No overdraft fee for items under $5

- Get Free Financial Planning Services with Citizens Checkup

Disadvantage

- Low interest rates on interest-bearing deposit accounts

- Only has offices in 12 states

- Some accounts have a $3 fee for using an out-of-network ATM

This is Citizens Bank fare

Citizens Bank is a solid choice for personal banking for those who live in Rhode Island, Massachusetts, or any of the 12 states with bank branches. It’s also a great option for students under 25 or over 65 due to the no monthly fee. This regional bank offers multiple accounts, although many are associated with premium banking services and require larger balances to be held.

Citizens Bank rates are not competitive. If you’re looking for a place to store your money to maximize your savings, you’d better check out one of the best online banks.