“Installment Loan” is a broad, general term that refers to the vast majority of personal and business loans made to borrowers. Installment loans include any loan that is repaid in regular payments or instalments.

If you’re considering applying for an installment loan, you should weigh the pros and cons first. Here’s what you need to know before you pull one out.

Central thesis

- An installment loan is a personal or business loan that the borrower must repay on a regular basis or in installments.

- For each period, the borrower repays a portion of the loan principal and pays the loan interest.

- Examples of installment loans include auto loans, mortgages, personal loans, and student loans.

- The advantages of installment loans include flexible terms and lower interest rates.

- Disadvantages of installment loans include default risk and loss of collateral.

What is an installment loan?

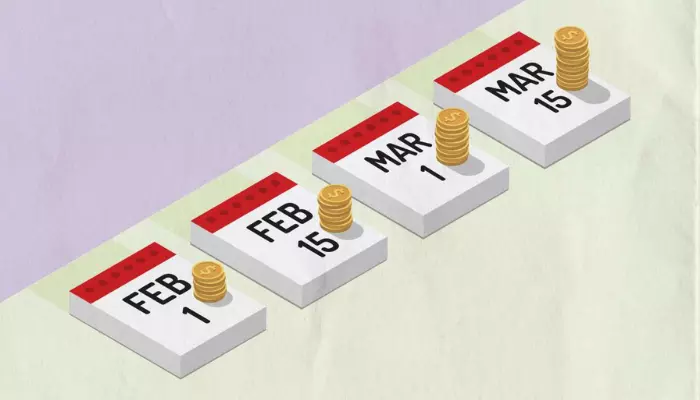

Installment loans provide borrowers with a fixed amount of money that must be repaid in regular installments. Every payment on an installment debt involves paying back a portion of the borrowed principal and paying interest on the debt.

The main variables that determine the amount paid on each term loan include the loan amount, the interest rate charged to the borrower, and the length or duration of the loan. The recurring monthly payment amount remains the same throughout the loan term, allowing borrowers to plan ahead for required payments.

Types of Installment Loans

Common types of installment loans include auto loans, mortgages, personal loans, and student loans. With the exception of mortgage loans (sometimes adjustable-rate loans where the interest rate changes over the life of the loan), almost all installment loans are fixed-rate loans, which means the interest rate charged over the life of the loan is the loan that was set at that point in time .

Secured and Unsecured Installment Loans

Installment loans can be secured (secured) or unsecured (unsecured). A mortgage is secured by the home the loan is used to purchase, while a car loan is secured by the vehicle the loan is used to purchase.

Some installment loans (often called personal loans) do not require collateral. Loans without collateral are granted based on the borrower’s creditworthiness (usually demonstrated by a credit score) and ability to repay (determined by the borrower’s income and assets).

Interest rates charged on unsecured loans are generally higher than those charged on comparable secured loans, reflecting the higher non-payment risk that lenders accept.

Apply for an installment loan

Borrowers apply for an installment loan by filling out an application with the lender, usually specifying the purpose of the loan, such as buying a car. Lenders discuss options with borrowers regarding down payments, loan terms, payment schedules, and payment amounts.

For example, if a person wants to borrow $10,000 to buy a car, the lender will inform the borrower that a higher down payment can earn the borrower a lower interest rate, or that the borrower can take out a lower monthly loan by taking out a long-term loan. Lenders also check the creditworthiness of borrowers to determine the loan amount and loan terms that the lender is willing to offer.

The borrower usually repays the loan by making the required payment. Borrowers can often save on interest costs by repaying the loan before the end of the term specified in the loan agreement.

Advantages and Disadvantages

Installment loans are flexible and can be easily adjusted in terms of loan size and tenor to best suit the borrower’s repayment ability according to the borrower’s specific needs. These loans enable borrowers to obtain financing at much lower rates than those typically available with revolving credit facilities such as credit cards. This allows borrowers to have more cash available for other purposes instead of making large cash outlays.

Advantage

- Ability to finance bulk purchases

- The payment amount generally remains the same throughout the loan term

- Interest costs can often be saved by paying off the loan early

Disadvantages

- Loan fees can be high

- Credit can be damaged due to late or missed payments

- Possibility to borrow more than necessary

One disadvantage of long-term loans is that borrowers may pay a fixed-rate loan at a higher-than-market rate. Borrowers may be able to refinance the loan at the prevailing lower interest rate.

Another major disadvantage of installment loans is that the borrower is associated with a long-term financial commitment. At some point, circumstances may cause the borrower to fail to make payments on time, putting the borrower at risk of default and possibly forfeiting any collateral used to secure the loan.

Installment Loans and Credit Scores

Paying off your installment loan on time is a great way to build your credit. Payment history is the most important factor affecting your credit score, and a long-term record of responsible use of your credit is good for your credit score.

As mentioned earlier, if you fail to make timely repayments or default on your loan, your creditworthiness could suffer – which is also a red flag in the eyes of lenders.

Final result

An installment loan can help you finance the purchase of a major commodity such as a car or a home. As with any loan, there are pros and cons to consider. The advantages are flexible terms and lower interest rates, the main disadvantage is default risk.

If you decide to take an installment loan, be sure to shop around and compare the rates and terms offered by the lender before signing off on the dotted line.

Learn more:

-

-

-

-

Delta Skymiles® Reserve American Express Card Review – See more.

-

AmEx focuses on customer experience with new checking account and redesigned application

-