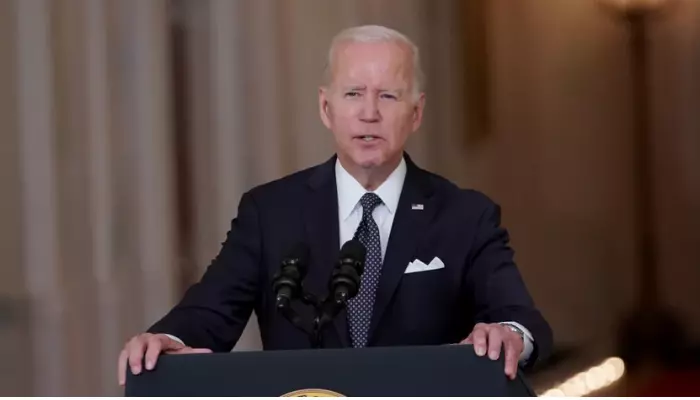

President Joe Biden may not decide whether to forgive student loans until July or August.

Here’s what you need to know — and what it means for your student loans.

Student Loans

In a frustrating setback for millions of student loan borrowers, Biden may not announce his decision to fully forgive students until later this summer. The president will “continue to weigh the political and economic consequences of the move to cancel student loans,” according to the Wall Street Journal, citing Biden administration officials. In late April, the president said he would announce a decision within a few weeks. However, six weeks later, Biden has not announced whether he will enact a comprehensive student loan tax.

Why student loan forgiveness has been delayed

Student loan forgiveness is delayed for several reasons. Biden, for example, may still be weighing the political pros and cons of this major policy decision. The White House has denied reports of Biden’s decision to cancel $10,000 in student loan debt. Proponents of broad student loan forgiveness, such as Sen. Elizabeth Warren (DMA), say deep student loan forgiveness will boost the economy and help student loan borrowers save extra money to get married, raise a family, buy a home and prepare for retirement savings. Opponents like Sen. Tom Cotton (R-AR) say broad student loan forgiveness is a huge transfer of wealth that will hurt those who didn’t go to college or don’t have student loans. Biden has forfeited $25 billion in student loans since taking office. He focuses on student loan forgiveness for specific groups of student borrowers. While Biden could continue targeted student loan easing, the question is whether he would agree to provide comprehensive student loan forgiveness to most or all of the 45 million student loan borrowers.

Biden may reconsider $50,000 student loan forgiveness

Biden ultimately ruled out $50,000 in student loan forgiveness. He supports $10,000 in student loan forgiveness, but never the larger amount advocated by Warren and Senate Majority Leader Chuck Schumer (D-NY). However, a renewed push from major civic and social groups could convince Biden to back $50,000 in student loan forgiveness. Why would Biden support more student loan forgiveness? The primary reason behind the $50,000 student loan cancellation is to reduce disparities and inequities and provide 36 million student loan borrowers the opportunity to eliminate all federal student loan debt. However, the most likely scenario for student loan forgiveness is the cancellation of $10,000 of student loans with an income cap of at least $125,000.

Biden can also weigh political implications

In addition to assessing the policy impact and the size of potential student loan forgiveness, Biden must also weigh the policy impact. The midterm elections are on Nov. 8, and Democrats are expected to lose their congressional seats. That could lead to Republicans winning at least one House of Congress, dividing the government and hindering the president’s legislative agenda. Progressive members of Congress believe comprehensive student loan legislation is critical to getting Democrats to vote this November. They think voters will or won’t vote for the Republican candidate if student loans aren’t cancelled. The counter argument is that if Biden implements a massive student loan tax, it could alienate independent and moderate voters. Democrats need both districts to stay in power in Congress.

Student Loans: Next Steps

If Biden delays the student loan forgiveness announcement until July or August, that would be closer to the end of temporary student loan forgiveness on August 31, 2022. This could have major implications for student loan borrowers waiting to know if they received at least some of their student loans will be cancelled. With student loan payments starting September 1, 2022, now is the time to prepare. Regardless of the president’s decision, you should have a game plan ready to pay off your student loans. Here are smart ways to save money:

- Student Loan Refinancing (Low Interest Rate + Low Payment)

- Income dependent on repayment (lower expenses)

- Student Loan Forgiveness (Federal Student Loans).

Learn more: